Mutual funds, index funds and ETFs are portfolios consisting of stocks, bonds or other investible securities. All three provide convenient alternatives to creating your own portfolio of individual securities and then trading them periodically.

They also fulfill one important rule of investment management: diversification into multiple securities. The amount of diversification depends on the holdings of each fund, or make-up of specific securities held in each mutual fund, index fund or ETF. It is always better to have about 5 to 20 specific uncorrelated mutual funds, or index funds, or ETFs in a portfolio for further diversification and safety.

Mutual funds

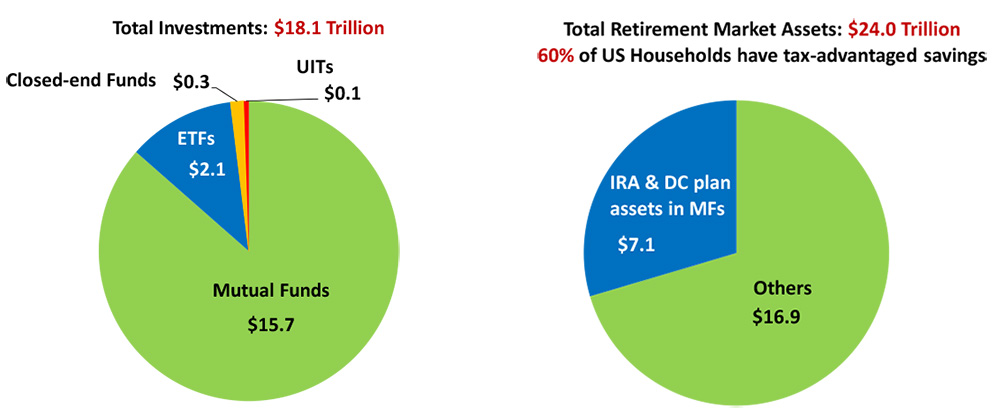

Mutual funds have been available for investment in the U.S. since 1924 (Open-end mutual funds). ETFs are relatively new, being available only since about 1993. ETFs are becoming popular, but the money invested in ETFs is a fraction of mutual fund investments ($2.1 trillion in ETFs vs. $15.7 trillion in Mutual Funds as of 2015).

- Mutual funds (as opposed to index funds) are actively managed. They are intended to give returns that are better than a pre-defined benchmark or index.

- They are portfolios managed by a fund manager who works for a company. The fund manager must exercise judgment each day, on what securities to buy or sell, how much, and when. The fund manager uses information provided by Wall Street brokers’ research-sales departments, institutional traders, and the company’s own market analysts.

- The net returns produced by a mutual fund depend on the market returns of the securities held by the fund, and the fund manager’s skills of buying and selling securities contained in the fund (in simple terms, skills of “consistently buying low and selling high!”), and on expenses deducted from the fund’s assets (Management fees, even marketing costs, and operating costs, including institutional broker commissions for executing the fund managers trading orders).

- Net returns of mutual funds are not affected by interactions of demand and supply between buyers and sellers, unlike stocks and ETFs. This is because mutual funds are not traded openly in the market. When you buy or sell shares of a mutual fund, you are actually buying and selling (returning) the shares from and to the fund company.

Index Funds

Index funds were made popular by Vanguard. Now many other fund companies are also offering them. But Vanguard has built an empire by selling index funds, and the company currently manages more trillions of dollars than Fidelity, which was previously the largest mutual fund company!

- Index funds are also mutual funds, but they are not managed actively. They are intended to simply follow a defined market index.

- It’s fairly easy to manage an index fund. The company first constructs a portfolio of stocks and bonds or other securities and weights their proportions to mimic a known benchmark or market index. Although, to complicate matters, some index funds have started using their own benchmarks whose daily value is not publicly available! The fund company simply buys and sells the securities contained in the portfolio, as and when their market prices change, such that their ratios remain identical to the weights of securities contained in the benchmark.

ETFs

An ETF (Exchange Traded Fund) does not have a fund manager. It is a portfolio with the same weight of investment in each security held, as would be for the benchmark or market index that the ETF is supposed to mimic.

- The return on book value produced by an ETF, depends almost entirely on the increase or decrease in the value of the benchmark or index that is tracked by the ETF, minus a much smaller amount deducted for expenses. But the actual net return can be affected by demand and supply interaction between buyers and sellers, since ETFs are traded openly in the market.

- Each ETF has a pre-defined and disclosed list of securities and their fixed weights, held within the ETF portfolio. The book value returns might not exactly match those of the benchmark, due to tracking errors, as the ETF changes weights of its holdings, to match those within the benchmark or index it is replicating.

- But lately, to confuse matters for the average investor, some ETFs are being introduced as “managed” ETFs!