Shine a light on your Funds

FundPOWER is a web based interactive tool that shows you which funds to buy, which funds to sell, and when.

TOUR

Use FundPOWER’s BUY/SELL indicators and ratings to find the best mutual funds or ETFs to invest in your 401k, IRA, or broker account. Automatically create and rebalance your portfolio for desired risk preference.

FundPOWER uses the Nobel Prize winning Efficient Frontier approach. It’s 100% data driven. No guess work! Read More >>

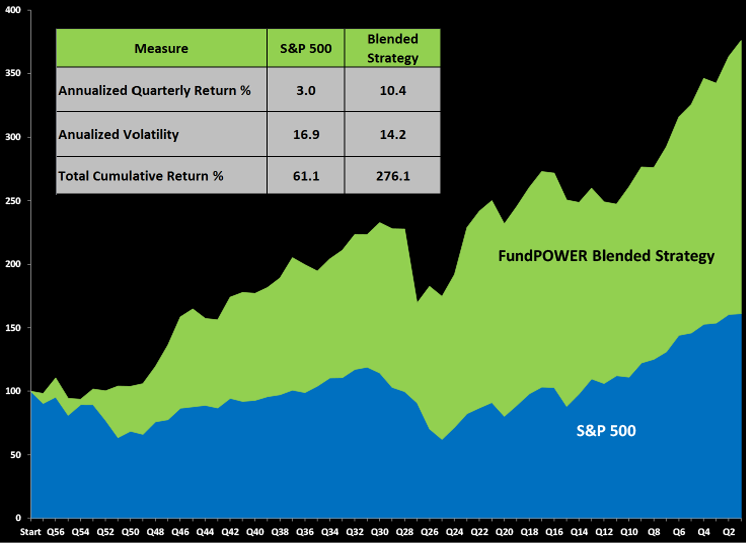

Our Results Prove It

DISCLAIMER: The above results are based on using FundPOWER reports at the end of each quarter, to select funds for investing in the following quarter. The back testing excludes trading commissions, assumes reinvestment of dividends, active management, and quarterly re-balancing of portfolio. Actual results can vary based on available mutual funds, market conditions and specific strategy chosen for investment. Even while the FundPOWER method is based on dynamically optimizing risk-reward balance and minimizing risk, and is not based on predictions, actual returns of investing in the market cannot be guaranteed. We are required by law to state that past returns are no guarantee of future performance.