While mutual funds, index funds and ETFs can give a wide range of investment choices, it is important to remember that the goals of the industry providing these products are inherently different from your investment goals and guidance information.

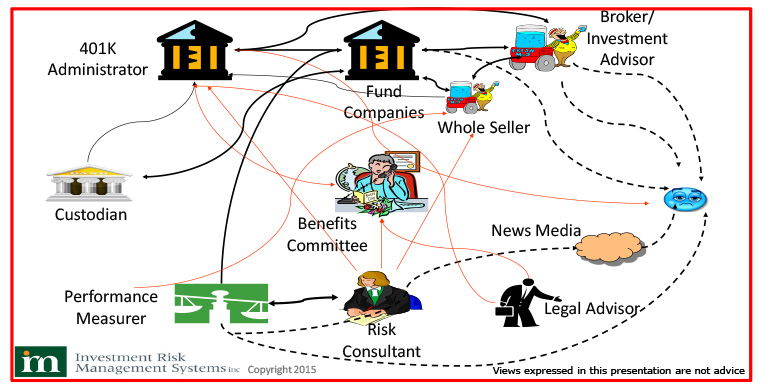

Fund companies, brokers, advisors, employers sponsoring retirement plans, plan consultants, administrators, custodians, rating companies, financial magazines and newspapers (– and many others), all focus on making money through fees and revenue, and by cutting costs.

We are told that investments always come with risk (true), hence our returns cannot be guaranteed (true). For decades, we have had no other alternative than to pay guaranteed amounts for the services, while only receiving a guarantee of HOPE. No exaggeration here, but simply HOPE! When investors don’t have, or don’t use the right investment know-how, it can be almost the same as going to Las Vegas to grow the nest-egg and hope to retire happily!

Yet, millions of oblivious investors trust brokers and advisors to do the right thing, and Wall Street continues to disregard Main-Street!

The complexity of the web of service providers surrounding an investor (not easy to find the investor, is it?), is illustrated by this picture:

Let’s look further beyond this general observation. It is well known that the typical investor’s decision to buy or sell a fund is primarily based on its last year’s total return. Some investors also look at total returns over the last 3, 5 and 10 years. Some others look at ratings that are based entirely on past total returns over 1, 3, 5 and 10 years. Morningstar ratings based on past total returns are unfortunately the most popular amongst individual DIY investors and even advisors. In short, investors depend on past total returns guidance information published by the industry. But they forget that the industry provides this information for the primary purpose of marketing. It also warns investors in fine print that “past returns cannot guarantee future performance.” And also note that the industry experts don’t use such information to manage their own funds or to create automated models sold through their wealth management divisions!

And each year, millions of investors lose tens of billions of dollars, while the industry makes tens of billions of dollars guaranteed income!

The case against investors’ “herd behavior” of chasing past total returns and traditional ratings is well stated by David Swensen, the well known and highly regarded investment manager for Yale University’s $24 billion endowment fund. He published an op-ed on August 13, 2011 in the New York Times.

This article is so important for individual DIY investors to read, that we decided to quote some portions here. According to Mr. Swensen:

- The companies that manage for-profit mutual funds face a fundamental conflict between producing profits for their owners and generating superior returns for their investors. In general, these companies spend lavishly on marketing campaigns, gather copious amounts of assets — and invest poorly. For decades, investors suffered below-market returns even as mutual fund management company owners enjoyed market-beating results. Profits trumped the duty to serve investors

- Mutual fund companies, retail brokers and financial advisers aggressively market funds awarded four stars and five stars by Morningstar, the Chicago-based arbiter of investment performance. But the rating system merely identifies funds that performed well in the past; it provides no help in finding future winners. Nevertheless, investors respond to industry come-ons and load up on the most “stellar” offerings.”

- This is serious business. The financial security of millions of Americans hangs in the balance.

Churning of portfolios by trying to “time the market” hurts investors’ returns, but helps brokers and advisors make more money. The effect of the industry’s use of traditional Star ratings is to encourage investors’ behavior of chasing past total returns. Investors sell funds that gave poor returns in the past, and buy funds that gave good returns. In simple terms they end up buying high and selling low.

This is a guaranteed way of losing money! Our analysis demonstrates the multi billions of dollars of losses incurred by investors each year.

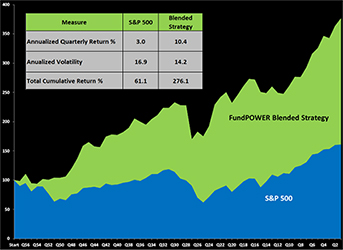

In our FAQ’s (about having access to Morningstar and Lipper ratings), we explain why relying on using traditional ratings does not work. The table below highlights the problem. It shows the results for 2010, 2011 and 2012, when investments in a sector were based on Star ratings of the previous year. Sometimes 3-Star funds gave better results than 5-Star funds, and the funds barely met the sector averages! Compare this with using FundPOWER, where the total returns of funds exceeded both S&P 500 and sector averages in the same time periods!

The problems of traditional ratings of fund performance and guidance information provided by the industry, and the damage they inflict on oblivious investors is so well known, that academic researchers all over the world are taking up the challenge to find solutions.

FOOTNOTE: ** Names such as Fidelity, Schwab, eTrade, Morningstar, Star Ratings and Lipper are trademarks owned by the respective firms. Their references are intended solely within the context of our explanations. **