Are ETFs and index funds better than mutual funds for investing?

The simple answer is: It depends on the likelihood of satisfactory performance from the specific fund or ETF selected for investment. Sometimes, a specific mutual fund might be a better choice, while at other times, an index fund or an ETF would be the right security to fit your specific return expectations and risk averseness.

It’s a myth that index funds in general, have better returns than mutual funds all the time. Our research data shows time and again that some index funds give better returns at some time periods than mutual funds, and vice versa.

But it is very hard, and generally not possible to correctly guess whether an index fund, mutual fund or ETF is the right choice for the specific situation. Almost all problems point to the investor’s lack of correct investment know-how, and lack of information on objective performance measures that are effective for selecting funds that have a high likelihood of giving expected returns at acceptable risk levels.

Ideally, if you can find index funds or ETFs that have optimal risk-return balance behavior (the balance you want, depending on your risk appetite), and their balance is better than that of mutual funds, then they would be better investment choices than mutual funds, or vice versa.

But this differentiation is not possible with traditional ratings and total returns data provided by the industry to investors.

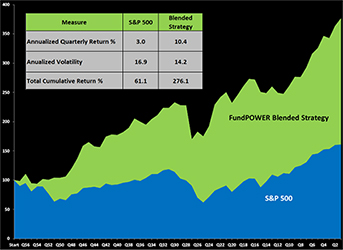

FundPOWER reports do the work for you automatically. Once you stop guessing future returns and simply follow the well proven methods established by MPT (Modern Portfolio Theory) and Efficient Frontier, you are freed from the confusion and noise around you.