We are totally surrounded by this myth. It’s deeply ingrained in us by the fund companies, brokers and advisors, and even by the universities. We have assumed that it is true, without looking at the facts.

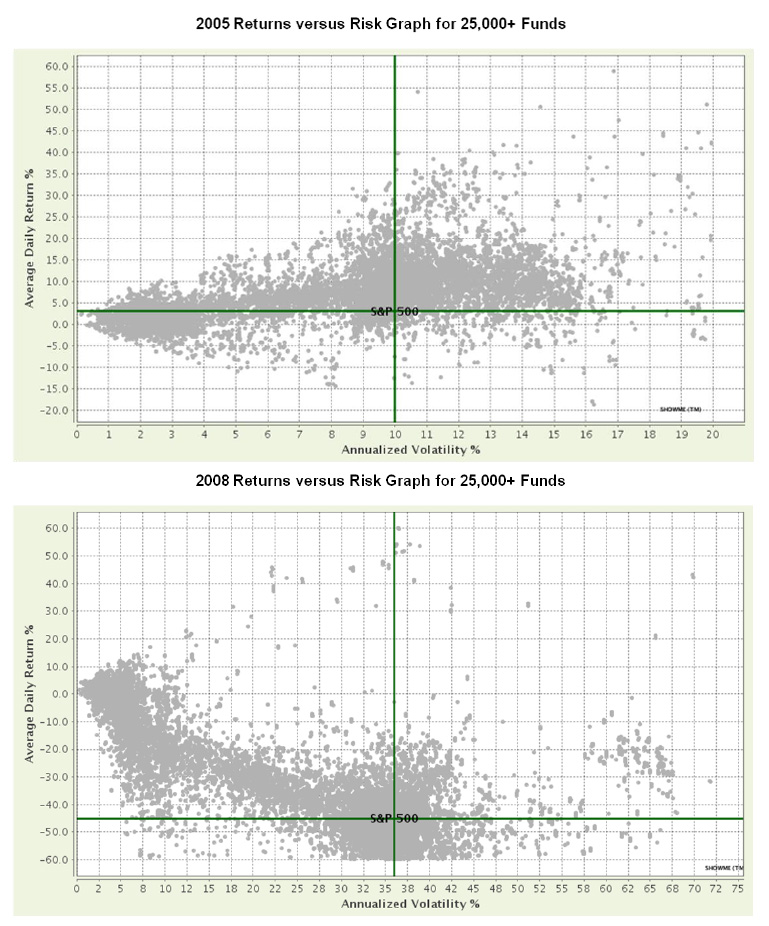

This myth is the result of mis-interpretation of well proven concepts of MPT (Modern Portfolio Theory) and Efficient Frontier, developed by Nobel Laureates (See the FAQ section of our website). The theory says that with efficient portfolios, in efficient markets, higher risk is required to expect higher return. Now let’s look at some quantitative data for about 25,000 fund symbols provided to us by a company that has been conducting advanced research in mutual funds and ETFs since 2008.

The gray dots are real funds. Not all funds are showing high returns, even as their risk is significantly higher than other funds. Does it mean that the data is wrong or the Efficient Frontier Theory is wrong? The answer is neither the data not the theory is wrong. The myth is wrong.

- The myth looks superficially at the Efficient Frontier, and forgets that it applies only to efficient portfolios and markets. In the uncertain, global economy of the 21st century, the market is not efficient.

- The data shows that most mutual funds and ETFs are not efficient, and hence their risk-return balance is not high enough to be on the frontier all the time.

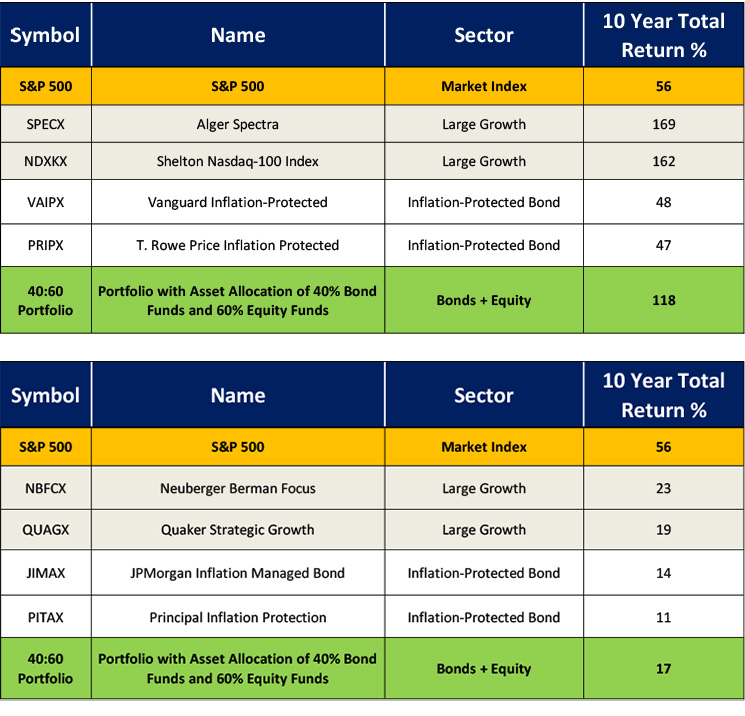

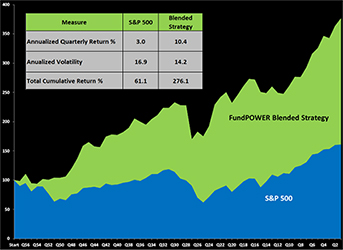

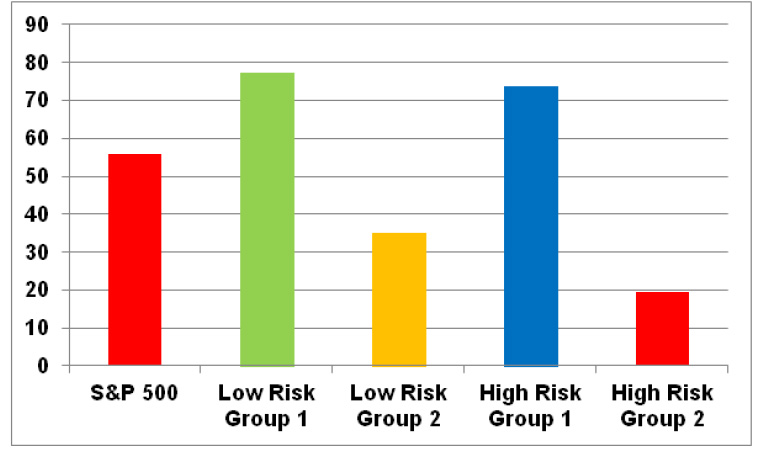

Another myth buster is our own analysis of total returns of almost 2000 funds provided to individual investors by brokerages such as eTrade, Schwab and Fidelity Investments.

We looked at the 10 year total returns produced by two groups of high risk funds and compared them with the total returns of two groups of low risk funds.

- Do you still believe that simply taking higher risk would have given you higher returns if you had not known earlier which group would have given the higher returns in the future?

- Or to get high returns, would you rely on luck to choose the right funds from the two high risk groups? Or would you rather prefer to use a proven way of selecting the best funds from the 4 groups?

And another myth stemming from misinterpretation of MPT is that “asset allocation in a portfolio is sufficient to get desired results in the future.” Yet this rule-of-thumb is not valid when selecting funds within an asset class, since their risk-return behavior may not really be efficient.

- Even within an asset class, some funds have significantly higher returns than others.

- So, incorrect choices of funds can lead to results totally different from those anticipated from the rule-of-thumb asset allocation.

- Here is an example of the importance of fund selection within asset classes. While two portfolios have the same asset allocation of 60:40 between equities and bonds, you will notice that one portfolio gives far superior results versus the other!