While mutual funds, index funds and ETFs can give a wide range of investment choices, it is important to remember that the goals of the industry providing these products are inherently different from your investment goals and guidance information.

Limited Choices in Retirement Plans, and Recent Cases of Corporate Fraud in Retirement Plans

Would it not be good to have hundreds of choices available to you right in your 401k account while you are employed? But what’s good for you might not be good for the employer, fund company, plan administrator or consultants.

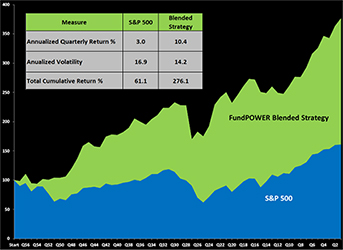

Busting the Myth of “High Risk Required for High Returns”

We are totally surrounded by this myth. It’s deeply ingrained in us by the fund companies, brokers and advisors, and even by the universities. We have assumed that it is true, without looking at the facts.

What are Mutual Funds, Index Funds and ETFs?

Mutual funds, index funds and ETFs are portfolios consisting of stocks, bonds or other investible securities. All three provide convenient alternatives to creating your own portfolio of individual securities and then trading them periodically.

Fees, Expenses, Loads and Minimum Investment Amounts

We have all heard these terms but what do they mean to us in terms of our investments? What do we need to be aware of when investing in funds? Do all these matter or are some less impactful on our investments than others?

Tax Efficiency, Dividends and Capital Gain/Loss Distributions

There is a lot of talk about the adverse tax impact of dividends and capital gains (short and long term) distributions by mutual funds, while ETFs are said to not have such problems.