Would it not be good to have hundreds of choices available to you right in your 401k account while you are employed? But what’s good for you might not be good for the employer, fund company, plan administrator or consultants.

Many retirement plans allow employees to invest in a small list of mutual funds and index funds. Some also allow a few ETFs. Of course, a money market fund or bank fund (almost close to keeping money in a current account with your bank) is also always available.

While you are earning money as an employee, saving through retirement plans is the right thing to do. As an employee working for a company, there is no immediate income tax for the amount of salary you put in your 401k or 403b account or on the investment returns. Uncle Sam and States or Cities, will charge you tax only when you withdraw from the account at retirement, or earlier if you withdraw your savings earlier. The same applies, even if you are self-employed and save through an SEP-IRA.

Here is how retirement plans are designed and administered.

Employers offer retirement plans such as 401k or 403b, to employees as an incentive and also as required by ERISA (Employee Retirement Income Security Act of 1974) of the U.S. Department of Labor. These plans are called “defined contribution” plans, where the employee can contribute a predefined maximum amount of his or her salary each month to his own retirement account. The total money invested by the employee in his own retirement account and its potential future growth, is controlled by the employee, not by the employer. Such plans are called “self managed.” No advisor can charge fees for such accounts for providing advice to an employee.

How many funds, and which specific ones to include in the plan, is decided by the employer’s retirement plan investment committee. This committee acts on behalf of the employer who is the sponsor of the plan. Employers don’t usually have the expertise and resources to design and administer the retirement plan. So they outsource the work to retirement plan consultants and lawyers who design the plan and recommend which funds to include in the plan. The same people or others who are called administrators do the work of accounting, custody of money, and executing trading orders of each employee, separately for his or her account.

All these services are a cost to the employer. So, most often, the employer goes for the plan consultant and administrator who will charge the least amount of annual maintenance fees to the employer, or deduct such costs from the retirement plan. Many times, the employer’s HR department is told to hold plan administration costs to a minimum (or at least not increase the costs year-overyear)! The question then becomes whether the employees get the best possible investment options or not? Employers are keen on keeping costs low and administrators are keen on making money. It’s a business transaction for them. So, who is focused on protecting and growing the employee’s nest egg? No one but the employee!

Let’s discuss “Investment Pools” as options included in retirement plans.

Many plans also include “investment pools.” They are identified by names such as “Low Risk Portfolio” or “Balanced Portfolio” etc., and might sometimes also have a symbol that looks similar to mutual fund symbols. Their symbols sometimes don’t end with an “X”. These symbols are only understood by the fund company that sells such pooled portfolios. They are not known to brokers most of the time, and cannot be used for trading in the market.

These pools are actually portfolios of actively managed or index mutual funds, and lately even ETFs, that are further “managed” by a fund company. So, the company “manages” the pool to apparently optimize your returns, by using portfolios that are also “managed” by them or someone else. It’s like double dipping in the chocolate sauce and that too openly! If this pool is that good, then why does the fund company not offer all the funds included in the pool, openly in the retirement plan and teach you how to “manage” your own portfolio consisting of those funds? At least you will be in-charge of your investments, as was the objective of the ERISA rule!

Investing in such pools is dangerous, in our opinion. Here are some reasons:

- Their market closing prices (unlike NAVs for real mutual funds) are not available publicly at the end of each day. So, unless you have tools to calculate and automatically track the pool’s performance over long periods in the future, you are left ignorant about their risk-return balance. This means that a critical piece of information is missing to allow you to make informed decisions as a smart investor!

- You are unwittingly paying the management fee and other expenses incurred by the fund company in “managing” the pool. Plus, their fees and expenses for the funds contained in such pools are also being charged to you before calculating the “net” price per share of your investment in the pool!

In short, if you invest in such pools, you would need to blindly trust in the past returns which the pool manager shows you. But then, no one knows if the pool’s management strategy changes or does not work as the market changes! You will get psychological satisfaction of investing your nest-egg easily and responsibly because you trust your employer to do the right thing for you. This is really not far from gambling! And with the latter, you at least know that you are going to spend money for fun (we hope for your sake!), without expecting to retire on your winnings!

Unfortunately, Federal and State retirement plans, and even plans for our military personnel, contain a large number of such pools as options for retirement. Even some well-known corporations include them in their employee retirement plans.

It’s amazing that the industry continues to treat Main-Street as oblivious and ignorant, even while the brainwork and efforts of the Main-Street are the foundation for the country’s economy!

Between the funds offered for investments and the “Investment Pools”, the quality of investment choices in retirement plans, is frankly poor.

Since the employer’s primary objective is to keep administration costs low, and since the plan administrator’s primary objective is to win the bid, the funds and choices offered generally end up to be limited and of poor quality. The administrators will often try to include funds that give them additional income, or more commissions if they are also the wholesaler of the funds, and so on. Many fund companies acting through one of their divisions as administrators, try to include mostly their own funds in retirement accounts, which are not popular amongst their retail customers, or which have higher management fees. So, don’t be surprised to find a very limited list of funds available in your retirement plans, and those too, of poor quality, even if you are working for a large employer! Many conflict of interest or fraudulent actions by retirement plan sponsors and administrators are coming out of the woodworks each year.

Fraud and neglect of fiduciary duty by employers for retirement plans – this is happening today, right before your eyes. So think twice before you blindly trust your employer’s goal of creating a retirement nest-egg for you. You need to be actively involved in managing your 401k investments. Avoid the “Investment Pools”, do your research and pick the better ones from the offered funds, and raise the issue with your employers, when you find that the funds offered by the retirement plan could be better.

Recently some fund companies and retirement plan advisors were sued because they were found to give preferential treatment to their own funds in such managed pools, instead of also allowing equal consideration to funds sold by other companies. Here are just a few cases to highlight what is going on right in front of your eyes. More and more professionals are become aware of such problems with their 401k plans, and are seeking legal recourse.

Hopefully, employers and plan consultants will eventually pay more attention to the quality of fund choices provided in the retirement plans.

Lockheed Martin Corporation, one of the largest defense contractors, has agreed to settle a $1.3 billion law suit.

- About 120,000 retirees and employees accused the giant defense contractor of providing a stock fund whose returns were worse than what they could get by simply investing in the open market.

- The employees also accused the company of charging high fees for their 401k plans.

Fidelity Investments, a large and well known mutual fund management company, and one of the largest providers of retirement plan administration services to employers, agreed to pay $12 million to settle a class action suit.

- The class action on behalf of more than 50,000 current and former employees alleged that Fidelity was profiting at the expense of its workers by offering high-cost fund options.

- Another lawsuit was about high administration fees charged by Fidelity to manage its retirement plan.

- The settlement amount is negligible, but indicates the potential conflicts of interest between 401k plan participants and providers.

A note on Pension plans.

Pension plans are different than “defined contribution” retirement plans such as 401k or 403b plans. With a pension plan, an employee is paid an amount of money by the employer at retirement. The employer is supposed to invest money in the pension plan and manage its growth on its own, or through an institutional or pension plan advisor. An employee has no control on the amount of money available at retirement. Employers have found that the cost of maintaining a pension plan can be a major drain on the finances of the company. Most employers are now trying to get rid of their pension plans, and are offering only 401k or 403b plans instead. There is nothing for you to invest, or manage with a pension plan. Just trust that your employer manages the plan well, and does not go bankrupt before you retire! Around 2008, Fidelity, then the largest mutual fund company, decided to

close its pension plan and only offer a 401k plan to its employees! There is something to learn from their action.

What are the important lessons learnt about 401k, 403b, or other retirement plans?

- Save as much as you can through your retirement account while you are employed. Money saved while you are earning is equal to the financial freedom in life when you don’t earn anymore!

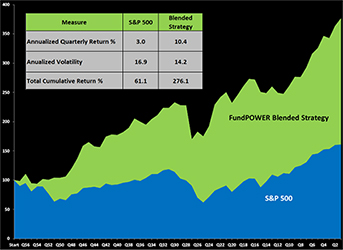

- Learn how to manage your investments yourself. Don’t blindly trust the guidance information, past performance and ratings provided to you by your employer or brokers. It’s mostly based on obsolete rules-of-thumb that don’t work anymore.

- When you leave your current job, move the money out of your retirement account to a RolloverIRA account, ASAP! Any discount broker will be happy to open the account for you, and also help you to transfer the money to the Rollover-IRA. Try to move the money in kind (shares of funds as you have in your account) if possible. There are no tax consequences in transferring to the Rollover-IRA. This will give you the opportunity to choose from almost 2000 no-load mutual funds and hundreds of ETFs that your broker provides instead of keeping the money in limited not-so-good funds, offered within the retirement plan!