We understand that it can sometimes be a little confusing to know which plan is right for you. We’ve put down some additional information on this page to help you. If you’re still unsure, we’d be happy to answer your questions. Use the form on the Contact page of our website or call (800) 308 – 7137.

FundPOWER Strategies

This Product is ideal for those who have their investments in a brokerage account, in addition to investments in their 401k / Deferred Comp plans, BUT would like to follow certain investment strategies and have us do all the heavy lifting to find you funds that fit the strategy of your choice.

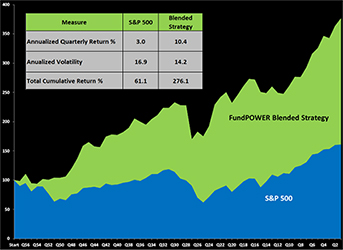

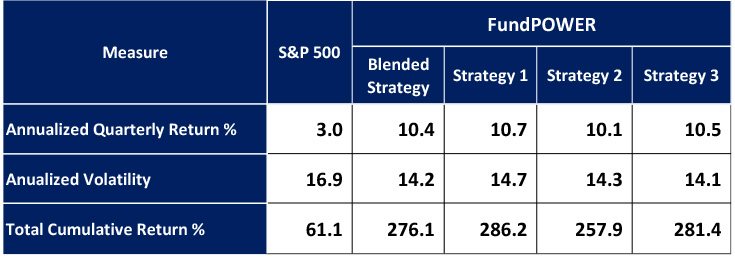

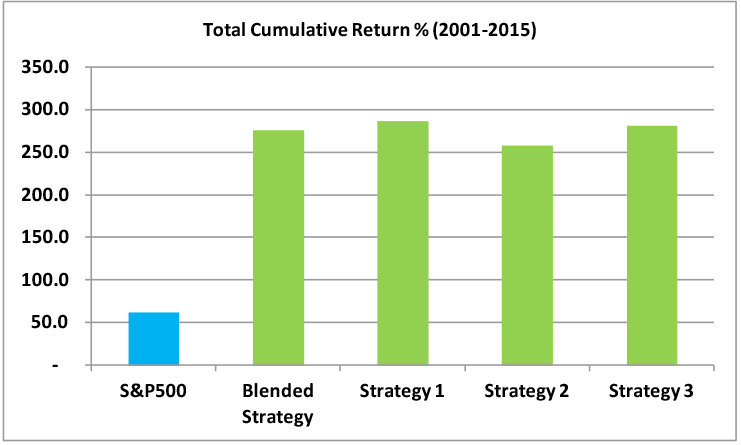

We have analyzed over 25,000 funds over 15 years to create our proprietary rating system. We then applied certain risk-return criteria and created 4 strategies for managing investments. These strategies were back-tested for 14+ years. The results of these strategies are shown below. Please note that the results shown are reflective of a very disciplined approach. the model assumed that the investments were made in all the recommeded funds (equally weighted) for a quarter. When the new fund list was created at the beginning of the next quarter, all the investments were moved into those new funds. This methodology continued quarter after quarter, over the back-testing period. This process ensured that the portfolio was optimized at least once a quarter. This is a disciplined approach that would require action on your part at least once a quarter.

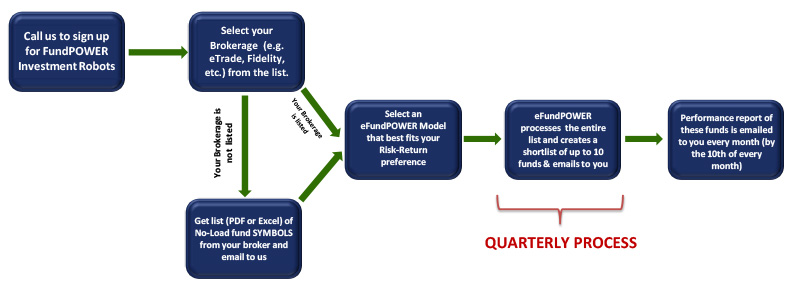

Call us to sign up for this service. Select your investment strategy and brokerage list at sign-up.

Most big brokerages offer 1500+ no-load funds for you to select from. It is difficult to find good funds from this long list. Our investment robots will apply the selected strategy to the selected brokerage list of funds and create a shortlist of up to 10 funds on a quarterly basis and send to you in a FundPOWER report. You don’t need to do any further analyses. We have done all the heavylifting for you. We recommend that you update your investment portfolio with the funds from this latest FundPOWER list. This will keep your portfolio optimized to fit your selected strategy. You will be emailed an updated performance summary of funds on a monthly basis (by the 10th of every month).

NOTE: We have fund lists from some of the big brokerage firms like eTrade, Fidelity, Schwab, etc. If your brokerage house is not listed, you can email us an excel spreadsheet with the fund SYMBOLS of all the no load funds offered by your broker. That list will be used for providing you the quarterly update. If you do not have the list from your broker (sometimes brokers don’t give the list even if customers ask for it!!!), you may choose to use our “Generic List” of no-load funds. HOWEVER, if you choose to use the generic list, PLEASE ENSURE that your broker offers the recommended funds as a no-load fund BEFORE you trade (did you know that each broker has a different list of no-load funds?).

Important: Based on the Buy / Monitor / Sell indication, you can rebalance your funds in your portfolios to ensure optimization of returns at the acceptable risk level. We suggest that you consider getting out of funds with a “Sell” indication as soon as they fall into that category.

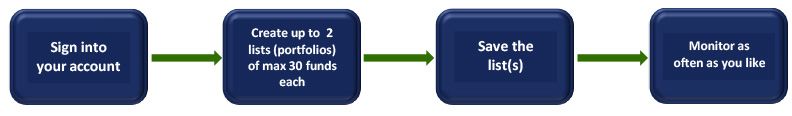

In addition to the above portfolio, you can also manage up to 2 such portfolios for 401K funds per household OR create 2 “WATCHLISTS” of funds (as in FundPOWER Basic). Each portfolio can contain upto 30 fund symbols. Monitor the portfolio(s) as often as you like (we recommend once a month or at least once a quarter). Each fund will have a Buy / Hold / Sell indication based on fund performance. Since funds offered within your 401k / deferred plans don’t change often, you can create the portfolio in your account once and monitor as often as you like. However, if needed, you can change the funds in your portfolios anytime.

If for whatever reason you need to cancel your annual subscription, we will refund you any remaining full months of your subscription.

Contact Us!